[Case Study]

Splitting this property up and creating a lease on the flat allowed us to leave £0 of our initial investment in this deal and after all expenses, returns over £500 per month and holds £77,000 worth of equity.

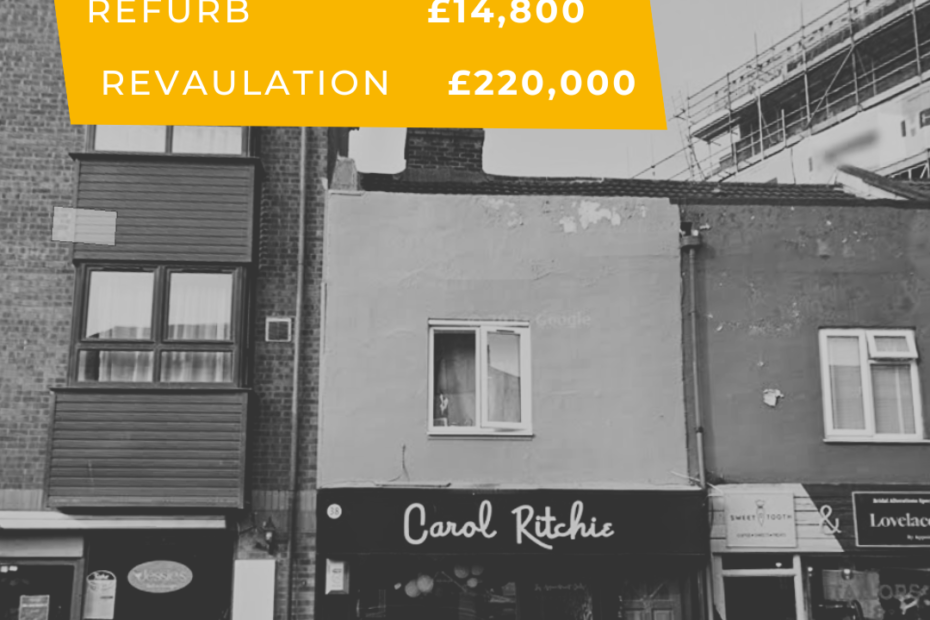

None of the Realm team had experience with commercial premises before, particularly with investment in mind. So this was yet another first for us and quite a big step. Situated on Albert Road, this commercial shop with a flat above was an interesting project and we learned a lot in a short space of time.

The title of the property incorporated the freehold, commercial and flat. We could see that there was money to be made if we were to rent both aspects. However there would be even more profit available to us if we were to create a leasehold on the flat. By doing this the flat and the shop could then be valued separately at market value.

The property

The property is in a prime location within Southsea and with plenty of shops and restaurants already thriving, we thought it wouldn’t be difficult to attract a business for the shop and tenants for the flat above. Given the age of the building there are certain covenants in place which restrict the type of business that could go into the shop. No alcohol or butchers, go figure. But that still left us with plenty of options. The commercial element is a very large ground floor space with an additional separate single storey outbuilding. Great for storage. The flat sits above the main commercial part on the first and second floors.

The property was purchased at £124,000. As the seller wanted to move quickly the property was bought outright using investor finance. Luckily for us some of our other projects had recently been refinanced so we were able to carry out repairs in the commercial shop. The flat was in good condition and we bought it with tenants still in situ.

Being a landlord on a commercial shop is very different to that of a residential property. There are fewer responsibilities and requirements to abide by. A commercial tenant is required to pay for any refurbishment and decoration to the interior of the property. So we are responsible for mainly the exterior of the building.

The work

We knew that there were some damp issues in certain areas of the shop but we had asked a specialist to take a look whilst we were going through the conveyancing process. These could be easily rectified by adding a damp proof membrane as the specialist thought that the ‘tanking’ that was used in the initial construction of the building was now failing.

As soon as the property was ours we arranged for the damp specialist to come in and carry out the repairs. We also installed some heating (as there was only one electric heater). Due to the damp repairs it meant that the walls had to be taken back to brick and then replastered. We then had the entire space prepped for a new tenant to come in and decorate.

We started advertising for a new shop tenant as the damp work was being done. A lovely local charity who dealt with second hand furniture wanted the shop as it was such a vast open space. As soon as the new plaster had dried they were able to get their own contractors in to decorate and adapt the interior space so it worked for them as a business.

Outcomes

Once the commercial shop and the flat were tenanted we then started looking at creating the leasehold for the flat. Then we could refinance both parts of the property and maximise our return. We sought advice from our accountants for tax purposes and appointed a solicitor who specialises in splitting titles and commercial legals.

The process to create the lease on the flat was quite drawn out. This was partly due to our situation, as we didn’t have certain documentation and plans that were required. However we were able to put a mortgage application forward for both elements whilst the legal paperwork was being completed.

This happened at the time when the Bank of England began to increase the base rate in an attempt to curb inflation. Resulting in significant increases in mortgage rates. Many mortgage products were pulled from the market and being replaced by higher interest variants. However we were able to secure a product that we were happy with, given the current climate.

The commercial premises, now tenanted, was valued at £90k. The flat, now as a separate entity, was valued at £130k. A total of £220k.

Since then sadly the charity decided that they could no longer remain in the shop. Before they had even vacated we had found and secured another lovely local business. A hugely talented hairstylist. They have done a fantastic job adapting and decorating the interior space so it suits their needs.